Author: Barry Cawthorn – Bawdens Managing Director

In the February and March issues of Industrial Property News, we identified industrial rental growth in 2022 was expected to continue in 2023, with growth again anticipated to exceed 10%.

For the first time since 1990, investors can potentially anticipate annualised returns to exceed the rate of inflation, but how are Australian investors doing compared to their peers in other developed markets?

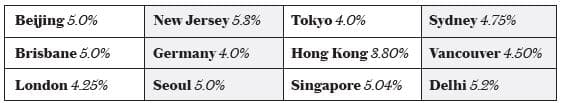

Primary and secondary industrial yields vary from location to location within a country as they do in Australia. However, in late 2022 the following yields were broadly observed from a variety of sources:

The tight spread observed in typical yields for modern functional space in large cities reflects the synchronized nature of global logistics today, with all markets experiencing very similar market behaviour at the moment.

Low vacancy rates as e-commerce continues to penetrate these sophisticated consumer populations.

Rising land and construction costs are presently underpinning existing capital values.

Significant growth in rentals continues as a result of inflation, and a supply/demand imbalance.

For more information, our latest edition of Industrial Property News can be found here: https://bawdens.com.au/bawdens-industrial-property-news-issue-157/.

Category: Research, Trends & Insights

Topics: Industrial Property Rentals, Inflation Adjusted Rentals, Data & Analytics

Solutions: Industrial Research, Performance Overview