Author: Barry Cawthorn – Bawdens Managing Director

Bawdens recently provided clients, a summary of market condition indicators for the financial year ahead. The findings in June 2023 appear to build upon previously completed research.

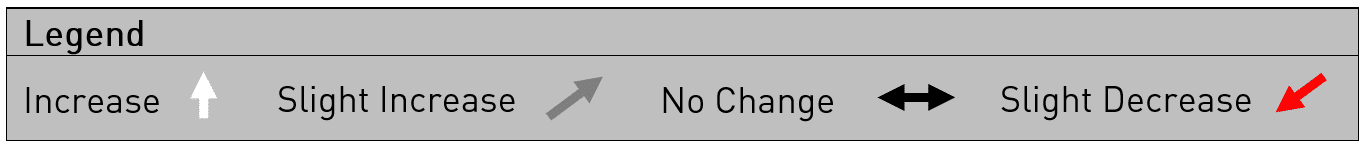

The following table compares the indicators at the end of last 2 financial years.

New Financial Year Outlook

Prices achieved for industrial property in the last financial year have shown no price falls, despite interest rates rising consistently throughout that period.

Rentals were forecast to rise in FY 2022-2023 and indeed they did, with an outlook for rentals continuing to rise, with a majority supporting the position that future rises will be required in the face of persistent inflation.

This appears to be because the inflation experienced in the year ahead will be supply led instead of demand led. Supply of buildings to buy and lease is expected to remain severely constrained, while users elect to do nothing as they manage the quickly escalating fixed costs of rentals and outgoings.

Despite limited space to buy on the market, demand for buildings to purchase was anticipated to fall in 2022 due to the rising interest rates, however, it was not the case. Indeed, confidence is expected to remain robust, reflecting the amount of money in the market today. Finally, the amount of vacant space was anticipated to slightly increase in the 2022-2023 year, however, that did not occur. Vacancy today remains below 1% and is expected to broadly remain unchanged in the financial year ahead.

For more information, our latest edition of Industrial Property News can be found here: https://bawdens.com.au/bawdens-industrial-property-news-issue-162/

Category: Research, Trends & Insights

Topics: Industrial Property Outlook for 2023-2024, Inflation Adjusted Rentals, Data & Analytics, Market Conditions, Price falls, Rising interest rates, Constrained Supply

Solutions: Industrial Research, Performance Overview