Author: Barry Cawthorn, Managing Director Bawdens

In the latest series of research reports released to private Small Medium Enterprise (SME) asset owners, Leading Industrial Agency Bawdens have identified that in 2022, for the calendar year to date, net face rentals have grown 16%. Further in 60% of new leases, the lessee received no incentive in the form of a net rental free period. Most recently, the company identified that the time taken to lease a property has fallen 32%.

Demand is continuing to exceed supply.

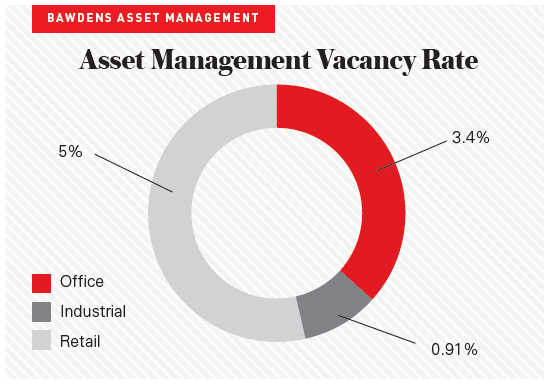

The graph above reveals research findings conducted by Bawdens, that out of the office, retail, and industrial sectors, industrial is the lowest. Sydney’s vacancy rate of 0.91% represented just 7,050m2 out of a surveyed total of 775,000m2.

Lack of serviced land and suitable redevelopment sites is constraining the new supply of space, leading to projects being fully sold prior to completion despite rising interest rates and the effects of inflation increasing replacement costs.

With rentals expected to therefore continue to increase investors will remain attracted to the indexed cash flows from industrial investments in the year ahead.

Category: Research, Trends & Insights

Topics: Industrial Vacancy, Data & Analytics

Solutions: Industrial Research