Author: Barry Cawthorn – Bawdens Managing Director

Bawdens is Sydney’s leading SME focused industrial and commercial agency.

The focus upon small to medium enterprises means the firm completes a very large number of industrial sales and leases annually, across its 2.8 billion dollars of assets under management.

In the first part of a two part study, research recently released to clients of the firm, revealed how interest rates affected the number of leases and sales completed (as a percentage of total transactions).

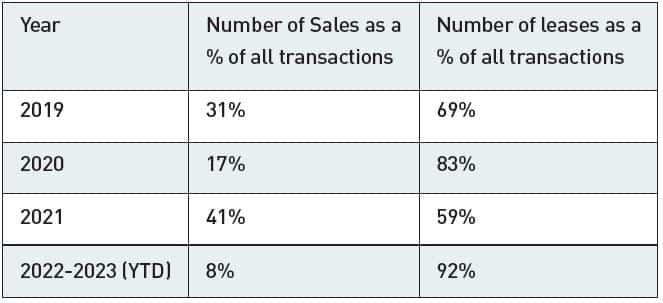

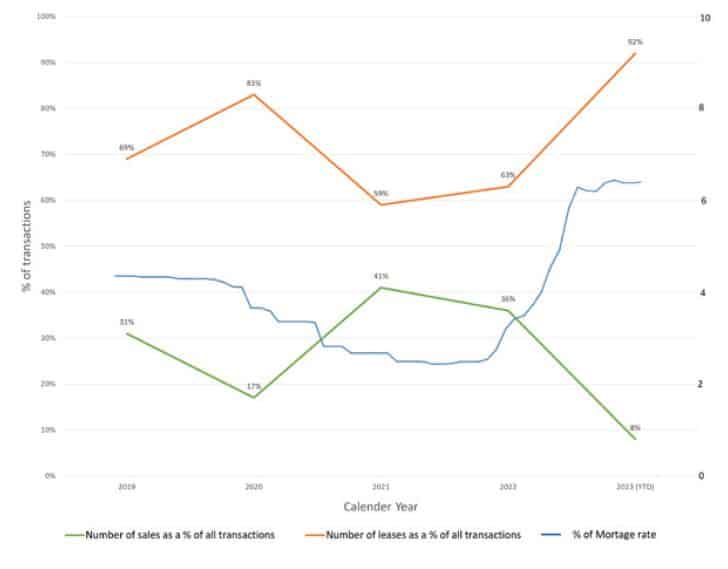

The company recorded the following:

The company then plotted these statistics over the same period as interest rates moved, as depicted in the graph below:

In 2019, with mortgage interest rates above 4% of all the transactions completed in 2019, 31% were sales.

As interest rates fell in 2021, of all transactions completed, 41% were sales, as buyers found the cost to own more attractive than leasing.

As interest rates rise in 2022 and 2023, out of all transactions completed so far in 2023, just 8% are sales, as mortgage cost rises above 6%.

In the next issue of Industrial Property News, we examine if the effects of rising interest rates mean business conditions have deteriorated, or might do so in 2023.

For more information, our latest edition of Industrial Property News can be found here: https://bawdens.com.au/bawdens-industrial-property-news-issue-159/

Category: Research, Trends & Insights

Topics: Industrial Property Rentals, Inflation Adjusted Rentals, Data & Analytics

Solutions: Industrial Research, Performance Overview