Author: Barry Cawthorn – Bawdens Managing Director

As supply remains very constrained, we expect occupier demand to remain high over the balance of 2023.

When coupled to a resurgance in population growth in Sydney, and the much talked about structural shift to servicing customers via e-commerce, we see a platform for continuing medium term demand for industrial space in both primary and secondary markets.

As we have settled into calendar year 2023, we have revised our projected rate of rental growth to be upwards for the year.

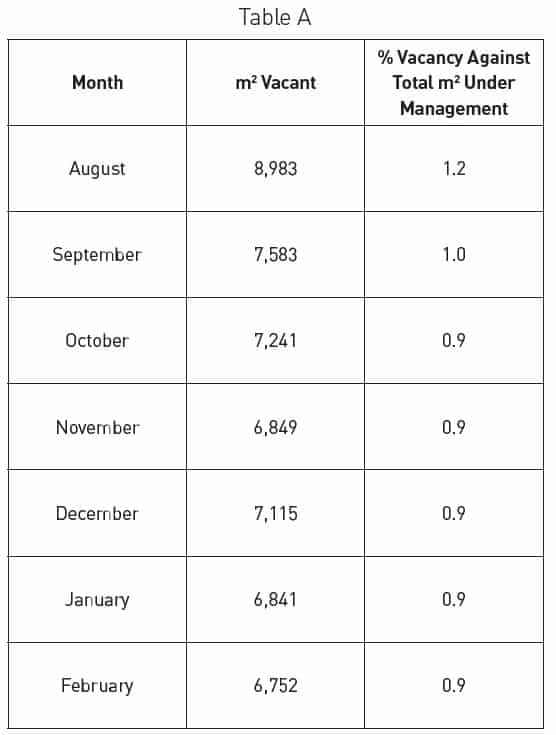

Table A (below) discloses the vacancy rate by square metres, and is expressed as a percentage of total square metres under management since August 2022.

We continue to observe that less than 1% of industrial space managed by Bawdens is available for lease.

This continuing lack of supply in primary and secondary markets will see net rental growth exceeding 25% on average for the balance of 2023, and at the time of writing, dropping back to 5-10% in 2024.

For more information, our latest edition of Industrial Property News can be found here: https://bawdens.com.au/bawdens-industrial-property-news-issue-158/

Category: Research, Trends & Insights

Topics: Industrial Property Rentals, Inflation Adjusted Rentals, Data & Analytics

Solutions: Industrial Research, Performance Overview