Author: Barry Cawthorn, Managing Director Bawdens

Leading Industrial Property specialists Bawdens have been observing continuing increases in net face rentals throughout 2022. This is a continuation of a trend that commenced in 2013 and more notably since 2018.

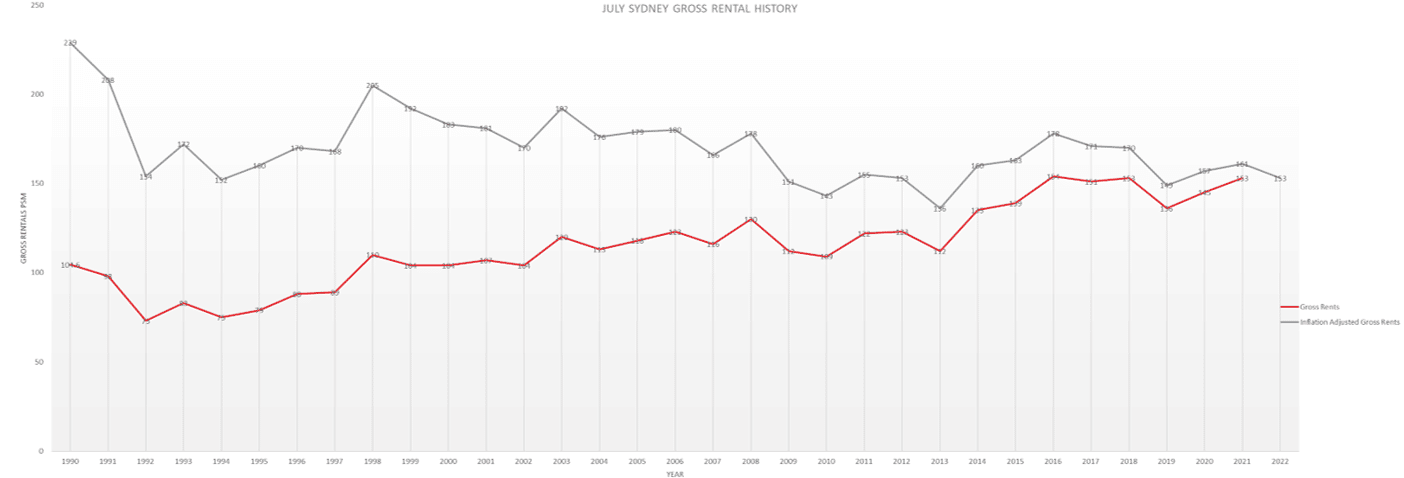

Industrial Property News asked the firm to identify what the monthly rentals for each July over the past 32 years were when adjusted for inflation.

The results can be seen below.

The adjusted rentals reflect the fact that inflation was 7.48% in 1990 and 3.77% in 2022.

This meant that in 2022 the rental has to be $229 psm gross today to have the same purchasing power as $105 psm gross in 1990.

Looking at 2020 we can see that interestingly; real returns have been falling since 1990 and negative for many years.

We can see that interestingly real returns have been falling since 1990 and negative for many years.

Whilst nominal cash flows reflect returns before factoring in expenses such as inflation and interest. With capital growth now not contributing to total returns in an environment of rising interest rates investors are quite increasingly looking to identify the true earning potential of an investment which is the cash flow generated by an investment after factoring in expenses such as inflation and interest.

Category: Research, Trends & Insights

Topics: Industrial Property Rentals, Inflation Adjusted Rentals, Data & Analytics

Solutions: Industrial Research, Performance Overview